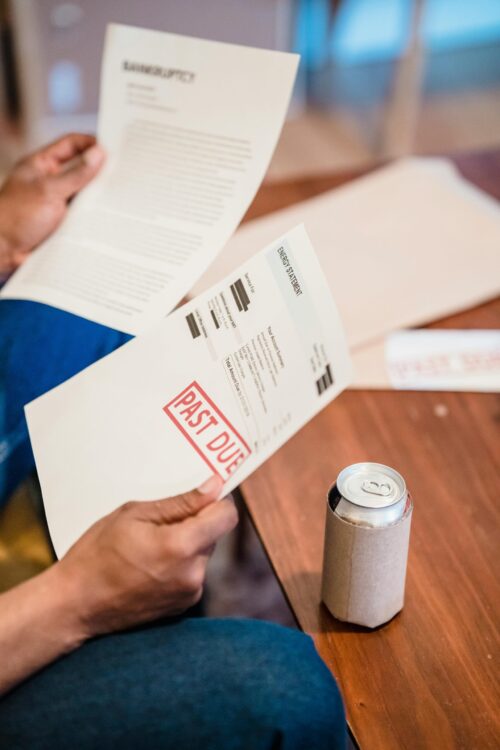

You fell behind on payments. The phone calls started. Then came the letters from aggressive debt collectors. Now, they are dropping the ultimate threat: “If you don’t pay this $5,000 balance, we will garnish your wages.” But can credit cards garnish wages in Texas?

It is a terrifying thought. Can a credit card company really call your boss and take 25% of your paycheck before you even see it?

If you live in most states, the answer is yes. But if you live in Texas, the answer is completely different.

Here is the truth about whether credit cards garnish wages in Texas, and the one dangerous loophole you need to watch out for.

The Short Answer: Can Credit Cards Garnish Wages in Texas?

Let’s cut through the noise.

No.

Under the Texas Constitution (Article 16, Section 28), “current wages for personal service” are exempt from garnishment for consumer debts. This means:

- Visa, Mastercard, and Amex cannot garnish your wages.

- Third-party debt buyers (like Midland Credit Management or Portfolio Recovery) cannot garnish your wages.

- Collection agencies cannot garnish your wages.

It doesn’t matter if they sue you and win. It doesn’t matter if you owe $500 or $50,000. In Texas, your paycheck is off-limits to credit card companies.

If They Can’t Garnish Wages, Why Do They Threaten It?

If you hear a debt collector say, “We will garnish your wages,” and you live in Texas, they are likely doing one of two things:

- Lying: Unscrupulous collectors bank on your fear. They hope you don’t know the law.

- Ignorant: Many collectors sit in call centers in other states and simply read a script. They don’t realize Texas has special protections.

Pro Tip: If a debt collector threatens to garnish your wages in Texas for a credit card debt, they may be violating the Fair Debt Collection Practices Act (FDCPA). You could actually sue them for harassment.

The Massive Loophole: The Bank Account Seizure

Here is where the “financial professional” in me needs you to pay attention. Just because credit cards cannot garnish wages in Texas, that doesn’t mean your money is safe.

Texas law protects your paycheck. It does not protect your bank account.

Here is the nightmare scenario that happens every day in Texas:

- The Lawsuit: The credit card company sues you and gets a judgment.

- The Wait: They wait for your payday.

- The Freeze: Once your paycheck hits your bank account, it is no longer “wages.” It is “cash.” The creditor serves a Writ of Garnishment on your bank.

- The Result: The bank freezes your entire account balance to pay the debt.

So, while they couldn’t intercept the money at your job, they took it at the bank.

Can Credit Cards Garnish Wages in Texas From Out-of-State Employers?

This is a common question in our remote-work world.

- “I live in Texas, but my company is headquartered in New York. Can credit cards garnish wages in Texas if my check comes from NYC?”

Generally, No. If you are a Texas resident and the work is performed in Texas, Texas laws usually apply. However, if your employer gets confused and honors a garnishment order from another state, you will have to fight to get it stopped. It is messy, but the law is on your side.

What To Do If You Are Sued by a Credit Card Company

If you receive court papers, do not ignore them.

- Show Up: If you ignore the lawsuit, they get a “Default Judgment” automatically. That judgment is the golden ticket they need to freeze your bank account.

- Claim Your Exemptions: If they try to seize your bank account, you might still be able to protect the money if you can prove it came from Social Security or child support.

- Settle: Once they realize they can’t garnish your wages, credit card companies are often willing to settle for pennies on the dollar because they know collecting from a Texan is difficult.

Summary

- Can credit cards garnish wages in Texas? No. Your paycheck is constitutionally protected.

- Can they take my money? Yes, via a bank levy (freezing your account) after they win a lawsuit.

- The Strategy: Don’t fear the wage garnishment threat—it’s empty. Fear the bank levy.

If you are dealing with an HOA or other debt obligations, check out my other articles to see what your next course of action is!

Written by Hayden

Leave a Reply