If you are searching for the California CCP 704.220 Exemption Amount in 2026, you are likely looking at a scary document from your bank or the Sheriff’s department.

I know you are thinking about one thing: How much money in my bank account is safe from debt collectors?

As a lender for more then 5 years now, I have seen debt collectors rely on your fear to get paid. But in California, they cannot empty your account. I know from experience that California has extremely generous consumer protections.

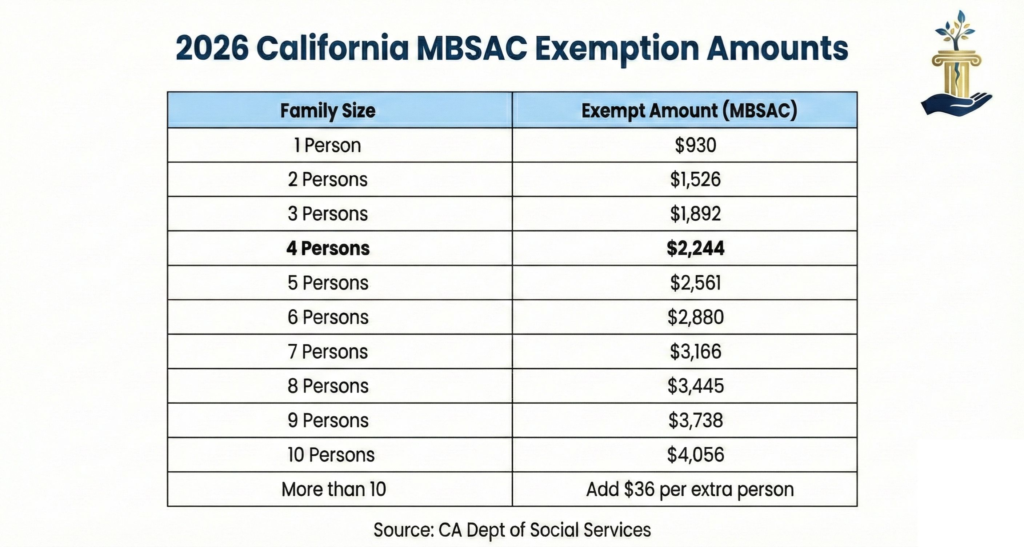

Here is the break down of exact exemption amount you are entitled to in 2026.

The 2026 Exemption Amount: $930 For Individuals

| Family Size | Exempt Amount (MBSAC) |

|---|---|

| 1 Person | $930 |

| 2 Persons | $1,526 |

| 3 Persons | $1,892 |

| 4 Persons | $2,244 |

| 5 Persons | $2,561 |

| 6 Persons | $2,880 |

| 7 Persons | $3,166 |

| 8 Persons | $3,445 |

| 9 Persons | $3,738 |

| 10 Persons | $4,056 |

| More than 10 | Add $36 per extra person |

Effective January 1, 2026, the automatic exemption amount for a deposit account under California Code of Civil Procedure (CCP) 704.220 is $2,244 for a family of 4 which I will be using as an example for the rest of the article.

This number is based on the “Minimum Basic Standard of Adequate Care” for a family of four and is adjusted annually by the California Department of Social Services (usually on July 1st).

What This Means For You

- It is Automatic: Unlike other exemptions, you do not need to file a claim for this specific protection. The bank is legally required to leave this amount in your account.

- It is a “Floor”: If you have $2,000 in your account, the debt collector gets *$0*. If you have $3,000, they can only take the amount over the exemption limit (roughly $756).

- It Protects “Any” Money: It doesn’t matter where the money came from. Even if it isn’t from Social Security or disability, this $2,244 is your survival shield.

Warning: This is Different From Wage Garnishment

This exemption (CCP 704.220) protects the cash sitting in your bank account. It is completely different from Wage Garnishment, which happens before you even get paid.

If you are dealing with a bank levy, it is highly likely the debt collector will try to garnish your wages next.

You need to protect your paycheck immediately.

I wrote a comprehensive guide on how to stop them from taking 25% of your paycheck, including how to use the “Minimum Wage Shield” to pay nothing if you fit the criteria. The basic premise of the idea is, even with garnishments, you should never make below California minimum wage of $16.90 per hour

Read Now: Can Debt Collectors Garnish Wages in California? (2026 Rules)

Summary: Your Immediate Next Steps

- Check Your Balance: If your bank account was frozen, ensure they left you at least $2,244. If they took more than that, notify the bank immediately citing CCP 704.220.

- Check for Social Security: If your money comes from Social Security, you have additional protections on top of this.

- Read the Main Guide: Don’t stop at protecting your bank account. Learn how to stop the lawsuit entirely in my full guide on California Wage Garnishment.

If you are experiencing threats of wage garnishments in other states like Texas or Florida, check out my other guids.

Written by Hayden

Leave a Reply