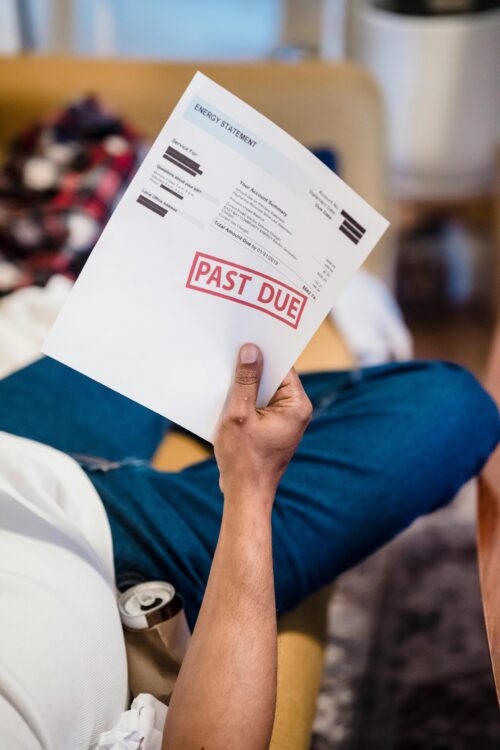

You open your mail and see the threat: “We will garnish your wages.” But can debt collectors garnish wages in California?

In many states, this is a nightmare scenario where you lose 25% of your paycheck overnight. But you live in California. And in California, the rules are different.

In this article I will share my knowledge as a lender for the past 5 years who has looked into every avenue of collection you can legally use.

While the short answer to “Can debt collectors garnish wages in California?” is Yes, the reality is much more complicated and usually much more favorable to you than the debt collectors want you to know.

California has some of the strongest anti-garnishment laws in the country. If you know how to use the “Minimum Wage Shield” and the “Claim of Exemption,” you might pay $0, even if you owe thousands.

Here is the 2026 guide to protecting your paycheck in the Golden State.

The General Rule: They Can’t Just “Take” It

First, let’s kill the fear. A debt collector cannot simply call your HR department and demand money.

For a credit card company, medical bill collector, or private lender to garnish your wages in California, they must follow a strict, slow legal process:

- The Lawsuit: They must sue you in Superior Court and serve you with papers.

- The Judgment: They must win the case (usually because you didn’t show up).

- The Writ: They must get a “Writ of Execution” from the court.

- The Sheriff: They must hire the County Sheriff to serve an Earnings Withholding Order on your employer.

If you haven’t been sued yet, your paycheck is safe.

The “Minimum Wage Shield” (Why You Might Pay Nothing)

This is where California law shines. In other states, collectors can take 25% of your disposable income, period.

In California (under SB 501), the math is different. The law protects a significant portion of your income based on the Local Minimum Wage where you work.

The California Formula: A debt collector can only take the LESSER of:

- 20% of your disposable earnings (down from the federal 25%).

- 50% of the amount by which your earnings exceed 40 times the local minimum wage.

What this means for you: If you earn close to minimum wage, your garnishment might be $0.

- Example: If you work in Los Angeles or San Francisco where the minimum wage is high, the “protected” amount of your paycheck is huge. If your check is smaller than that protected floor, the collector gets nothing—even if they have a court judgment.

The “Magic Wand”: The Claim of Exemption

If the standard formula still takes too much money, California gives you a “Get Out of Jail Free” card called the Claim of Exemption.

This is not a loophole; it is your legal right.

- The Form: It is called Form WG-006 (Claim of Exemption).

- The Argument: You simply declare that you need your entire paycheck to support yourself and your family (rent, food, gas, utilities).

- The Result: If a judge agrees that taking 20% would cause you financial hardship, they can reduce the garnishment to 0%.

Pro Tip: Most debt collectors know that if you file a Claim of Exemption, they will likely lose. Often, just filing the paperwork is enough to make them negotiate a tiny settlement.

The Bank Levy Trap (The Real Danger)

Just like in Texas, the biggest danger in California isn’t always wage garnishment—it’s the Bank Levy.

If a collector has a judgment, they can order the Sheriff to freeze your bank account. However, California protects you here too.

- The Automatic Exemption: California law (CCP 704.220) creates a “minimum balance” shield. A certain amount of money in your account (tied to the poverty line) is automatically exempt from being seized without you lifting a finger.

- Social Security is Safe: Federal and state benefits are 100% exempt from bank levies.

Read more about the Bank Levy and how you can keep your money even if they try this tactic.

What To Do If You Get a “Notice of Levy”

If your employer hands you an “Earnings Withholding Order,” do not panic.

🧮 Check Your Paycheck Now

Don’t trust their math. Use my free calculator below to see exactly how much is protected under California SB 501:

Tool created by California Wage Garnishment Guide

- Check the Math: Use a California Wage Garnishment Calculator. Ensure they aren’t taking more than the “Minimum Wage Shield” allows.

- File Form WG-006 Immediately: You usually have 10-15 days to file your Claim of Exemption with the Sheriff listed on the paperwork. Do this immediately. List every expense you have.

- Offer a Settlement: Once you file the exemption, call the collector. Tell them: “I just filed for an exemption because I’m broke. The judge is going to give you $0. Do you want to settle for $50 a month instead?”

Summary

- Can debt collectors garnish wages in California? Yes, but only after a lawsuit.

- How much can they take? Usually 20% or less—and often $0 if you are a low-income earner.

- Your Weapon: File Form WG-006 (Claim of Exemption) to prove you need your money for rent and food.

If you are dealing with an HOA, or are in another state dealing with Credit Cards or other debt obligations. Check out my guides to see your next steps in defending yourself.

Written by Hayden

Leave a Reply