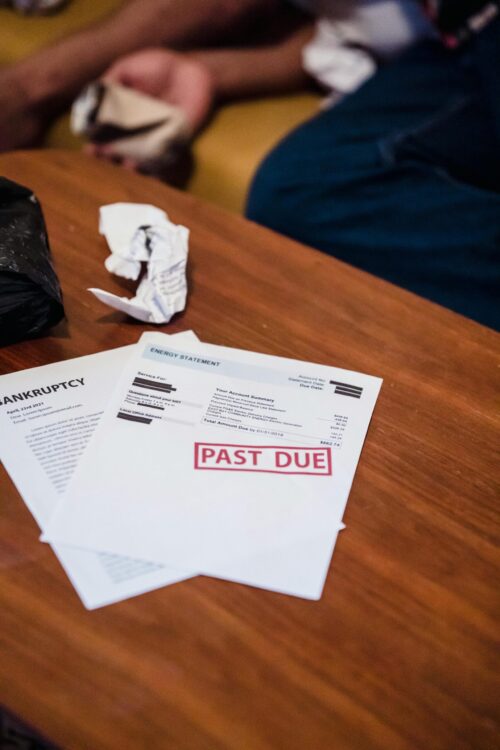

You missed a few dues, an annoying neighbor complained about untrimmed shrubs. Then came the late fees. Then came the threatening letters from a law firm you’ve never heard of. Now, the fear sets in: Can the HOA actually call my boss and garnish my wages?

It is one of the most common questions panic-stricken homeowners ask, and the answer is not a simple “yes” or “no.”

In this article I will share my knowledge as a lender in my day job for the past 5 years on what debt collectors can and cannot do.

The short answer is: Yes, in many states, an HOA can garnish your wages, but they cannot just decide to do it today. They have to sue you first.

However, if you live in a state like Texas, Pennsylvania, South Carolina, or North Carolina, the rules are completely different, and your paycheck might be 100% protected.

Here is the reality of HOA wage garnishment and how to protect your income.

The General Rule: Yes, But They Need a Judge

First, let’s debunk the biggest myth: An HOA cannot simply send a letter to your HR department demanding a cut of your paycheck. They are not the IRS, and they are not the Department of Education.

For an HOA to garnish your wages in most states (like Florida, California, or Georgia), they must follow a strict legal roadmap:

- The Lien: They file a lien against your property to secure the debt.

- The Lawsuit: They must sue you in civil court for the unpaid dues.

- The Judgment: They must win the lawsuit and get a judge to sign a “Money Judgment” against you.

- The Garnishment Order: Only after they have that judgment can they ask the court for a separate order to garnish your wages.

If you haven’t been sued yet, your paycheck is safe for now.

The “Safe” States: Where Your Wages Are Protected

If you are reading this from Texas, Pennsylvania, North Carolina, or South Carolina, you can breathe a little easier. These states have unique laws that generally prohibit wage garnishment for “consumer debts”—and HOA dues typically fall into that category.

Texas (The “Safe Haven”)

In Texas, wage garnishment is constitutionally prohibited for almost all debts.

- Can an HOA garnish my wages in Texas? No.

- The Exception: Wages in Texas can only be garnished for court-ordered child support, spousal support, unpaid taxes, and defaulted federal student loans. An HOA (or a credit card company) cannot touch your current wages.

Pennsylvania, North Carolina, & South Carolina

Similar to Texas, these states have strong protections against wage garnishment for private debts.

- North Carolina & South Carolina: Garnishment is not allowed for private creditors like HOAs. It is reserved for taxes, student loans, and family support.

- Pennsylvania: Wages are generally exempt from garnishment for commercial debts.

Warning: Even in these states, if you work for a company based in another state, or if the judgment is domesticated elsewhere, things can get tricky. But for the vast majority of homeowners in these four states, your paycheck is safe from the HOA.

The “Backdoor” Garnishment: The Bank Levy

This is the trap that catches people in “safe” states like Texas.

Just because the HOA cannot touch your paycheck while it is with your employer, that doesn’t mean they can’t touch your money.

Once your paycheck hits your bank account, it is no longer considered “current wages.” It becomes “cash assets.”

- The Risk: In almost every state (including Texas), if an HOA has a court judgment against you, they can ask the court to freeze and seize the money in your bank account.

- The Reality: You wake up on payday, check your balance, and see $0.00 because the bank was served a “Writ of Garnishment” on your account.

So, while they can’t intercept the money before you get it, they can take it after you deposit it. If you live in California, you have a secret weapon you can use to fight back which I have written about.

What To Do If You Receive a Threatening Notice

If you receive a notice of intent to sue or garnish, do not ignore it. The “Ostrich Strategy” is how people lose their bank balances.

- Validate the Debt: Under the Fair Debt Collection Practices Act (FDCPA), you have the right to ask for proof. Make them show you the accounting ledger. HOAs are notorious for bad bookkeeping.

- Check Your State Law: If you are in one of the protected states mentioned above, write a letter citing the state code that prohibits wage garnishment. Sometimes, third-party debt collectors hope you don’t know the law.

- Offer a Payment Plan: HOAs usually want money, not a legal battle. If you offer to pay the principal (the actual dues) in exchange for waiving the late fees and attorney costs, many boards will accept just to close the file.

Summary

The Danger Zone: Watch out for a Bank Levy, which can happen even in states where wage garnishment is illegal.

Can an HOA garnish wages?: Yes, in most states, but only after a lawsuit.

Is Texas protected?: Yes, Texas prohibits wage garnishment for HOA debts.

Written by Hayden

Leave a Reply