Solving for the Texas teacher pension gap in early retirement

Is your teacher pension enough? It likely isn’t if you plan on taking a pay cut during retirement. Learn how to bridge that gap with a 403(b) account and a dividend investing strategy that prioritizes ownership and long-term wealth building. It isn’t easy but you can solve the Texas teacher pension gap in early retirement by making a few changes.

The Reality of the “Pension Gap”

If you are an educator, you have likely been told that your pension is the “golden ticket” to retirement. It is a comfortable narrative: work hard for 30 years, retire, and relax. As a financial professional who analyzes risk for a living, I can tell you relying on a single asset to fund your retirement is unnecessarily risky.

But if you take the time to look closely at the numbers of the situation, the math often doesn’t add up.

In many states, including Texas, teacher pensions are designed to replace only 60% to 70% of your pre-retirement income. Furthermore, because of the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), many public school teachers are not eligible for Social Security. This creates what we call the “Pension Gap”, a 30-40% shortfall in income that you are responsible for filling. The Texas teacher pension gap in early retirement is a real problem if you dont plan to fill it.

Before you panic, look at the numbers. If you are currently saving 10% of your income, you are already used to living on just 90% of your salary. Since your pension replaces roughly 70%, you are already 7/9 of the way there.

The Real Gap: You are looking at a 20% to 30% shortfall, not 40%.

Congratulations! You just cut the problem in half before investing a single dollar. Now, let’s talk about how to solve the rest.

The default solution offered in the breakroom is usually a high-fee 403(b) annuity. However, to truly build wealth and secure financial freedom, you need to move from a mindset of saving to a mindset of ownership. This is where a dividend growth strategy comes in.

Why Your 403(b) Might Not Be Enough

The 403(b) is the public sector’s answer to the 401(k), but it often comes with distinct disadvantages. Unlike the private sector, where low-cost index funds are standard, the 403(b) landscape is frequently dominated by insurance products.

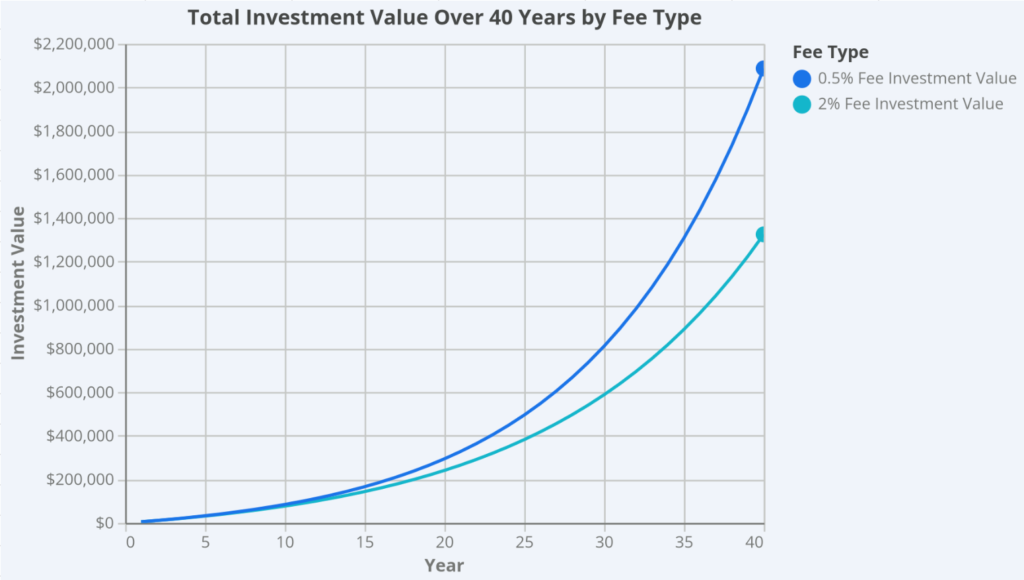

Many teachers unknowingly sign up for variable annuities with high mortality and expense (M&E) fees that can eat away at 2% to 3% of their returns annually. Over a 30 year career, these fees can cost you hundreds of thousands of dollars in lost compounding.

The “Ownership” Problem When you buy an annuity, you are essentially buying insurance. When you buy dividend stocks or ETFs, you are buying equity, an actual ownership stake in profitable, operating businesses.

The most efficient engine for wealth creation is owning assets that generate value. Dont just be a consumer of the system; be an owner of it.

The Dividend Bridge: A Strategy for Teachers

Dividend investing focuses on buying shares of companies that pay out a portion of their profits to shareholders regularly. For a teacher facing a pension gap, this strategy offers two powerful benefits:

- Cash Flow: Dividends provide liquid cash that can supplement your pension checks without requiring you to sell your principal investment.

- Inflation Protection: Quality companies tend to raise their dividends over time (Dividend Growth), helping your income keep up with the cost of living, something many fixed pensions struggle to do.

Step 1: The “Match” Rule

Before looking outside your 403(b), check your district’s policy. If your employer offers a matching contribution, contribute up to the full amount they match. That is a guaranteed 100% return on your money.

However, if there is no match, or once you have maxed it out, pause. Do not blindly dump excess capital into a high-fee plan.

Step 2: The Roth IRA Advantage

For most teachers, the ideal vehicle for dividend investing is a Roth IRA. Since you contribute post-tax dollars, your dividends grow tax-free, and you can withdraw them tax-free in retirement.

Given that teachers often have a taxable pension in retirement, having a tax-free income source allows for better tax planning later in life.

Step 3: Selecting Quality Assets

You don’t need to be a stock market wizard to do this. The goal is to buy companies with a history of stability and growth.

- Dividend Aristocrats: These are S&P 500 companies that have increased their dividend payouts for at least 25 consecutive years.

- Dividend Growth ETFs: Funds like Vanguard Dividend Appreciation (VIG) or Schwab US Dividend Equity (SCHD) allow you to own a basket of hundreds of high-quality companies with a single purchase.

- S&P 500 ETF: Funds like Vanguard S&P 500 ETF (VOO) and SPDR S&P 500 ETF Trust (SPY) both own the top 500 companies in the United States and is the benchmark for all other investments. Although the dividend payouts are lower, you have added a “growth” engine to complement your “income” engine.

Note: This is not financial advice, but an illustration of how owning a diversified slice of the American economy can outperform complex insurance products.

Avoiding the “Debt Trap”

Building wealth is like filling a bucket; it’s impossible to do if there are holes in the bottom. High-interest consumer debt is the biggest hole in the financial bucket of the American middle class.

While a mortgage is a tool for asset acquisition, and student loans can be an investment if they get you into a career, credit card debt and loans for depreciating assets (like luxury cars) destroy wealth.

To successfully execute a dividend strategy, you must aggressively eliminate consumer debt. Every dollar paid in interest to a bank is a dollar that could have been working for you, earning dividends.

The Bottom Line: Take Control

The system works best for those who understand it. You cannot rely solely on a state pension or a salesperson in the faculty lounge to secure your future.

By taking ownership of your financial gap, avoiding bad debt, and investing in the market, you move from being a passive participant to an active builder of wealth. Start small, be consistent, and let the power of compounding fill the gap.

Key Takeaways for Teachers

- Audit Your 403(b): Check if you are in a high-fee annuity or a low-cost mutual fund platform. If you want to look at other options your employer offers then check out this guide to 403(b) vs 457(b) for Texas Teachers.

- Calculate Your Gap: Estimate your TRS/Pension payout and compare it to your expected expenses. Most likely, you are one of the people exposed to the Texas teacher pension gap in early retirement.

- Prioritize Matching Accounts Then the Roth: Employer matches offer instant 100% returns so those are an absolute must, beyond that use a Roth IRA to build a tax-free stock portfolio.

- Focus on Ownership: Invest in assets that produce cash flow and provide growth opportunities, rather than products that just promise safety with a high fee structure.

Written by Hayden

Disclaimer: I am an investor and professional risk manager, not a CPA. This is for educational purposes. Always read the prospectus of your specific district’s plan. I have no affiliate links in this article.

Leave a Reply