I have been investing for over a decade, and have a day job in the risk department of a commercial lending company with over $250 Million in loans originated using the system I built. I spend my life analyzing downside scenarios. But when it comes to my personal portfolio, there is one risk I refuse to take: selling my shares too early because I am selling covered calls on Tesla (TSLA).

I am a long-term bull. I believe the company’s future in AI, robotics, and energy will eventually drive the stock price dramatically higher than it is today. Because of this high conviction, my goal is simple: never sell the shares.

However, holding a volatile stock like Tesla can be a wild ride. Instead of just letting that equity sit idle, I use a strategy called selling covered calls. This allows me to generate consistent income from my position, hedge against volatility, and most importantly, buy more shares.

Here is the last 4 years of my decade long story being a Tesla HODLER, using the covered call strategy on Tesla to build wealth, including the times I had to fight to keep my shares.

The Strategy: Why I Sell Covered Calls on Tesla

If you are looking up “how to sell covered calls on tesla shares,” you probably already know the basics: you own 100 shares of stock, and you sell someone else the right to buy them from you at a specific price (the strike price) by a specific date. In exchange, they pay you cash (premium).

For most people, the goal is to have the shares called away for a profit. For me, that is the worst-case scenario.

My strategy is different: If you already know how covered calls work, skip this bulleted section below, you already know this.

- Sell Out of the Money (OTM) Calls: I target “weeklies” with strike prices ~8-10% above the current market price. This conservative buffer minimizes assignment risk while generating 0.2% – 0.3% yield per week (roughly 10% – 15% annualized). If you want to know why I dont mind giving up the theta decay over the weekend, read this article.

- Collect the Premium: I use this cash to buy more shares or diversify.

- Manage Aggressively: If Tesla’s price rips higher and threatens my strike price, I “roll up and out” buying back the option at a loss and selling a new one for a credit further out in time. Effectively buying myself more time but instead of having to pay for it, I get paid for another week at a reduced rate.

Why Sell Covered Calls on Tesla and Not Another Company?

Personally, Tesla is the perfect stock for me to use this strategy on because 1. I want to hold it and 2. It is extremely volatile. Implied Volatility (IV) is your friend when you are short options like a covered call strategy is. Selling a call option with 1 week to expiration and 8% out of the money on Coca-Cola (KO) would yield you next to nothing in premiums. This is because the odds of KO going up 8% in just 5 days is basically 0% except around there earnings releases. To put this into numbers, at the time of writing in 2026 the IV of TSLA is 45% and KO is 18%. This means TSLA is expected to be more then twice as volatile and you can sell options more then twice as far out of the money for the same premium yield assuming the market is functioning properly.

Phase 1: Accumulation (2020-2022)

I started selling covered calls on Tesla in 2020 but my brokerage account only goes back 4 years. Looking back at my trades from early 2022 and the market was in a completely different place. Tesla was trading at pre-split levels (strikes like $1,100 and $1,300), and volatility was high.

During this period, my focus was pure accumulation. I viewed every dollar of premium as a coupon to buy more stock.

In 2022, I was consistently selling covered calls on Tesla and collecting premiums ranging from $20 to $80 per contract. It doesn’t sound like much, but it adds up especially with me selling many contracts per week.

By March of 2022, that discipline paid off. My transaction history shows a series of “Buy” orders for Tesla stock. I was using the income generated from the volatility of the stock to buy more of the stock. This created a flywheel effect: more shares meant I sell more contracts, which generated more income to buy more shares. I was able to use this for the few years2022 was the last year I purchased Tesla shares. In mid 2022 I realized my TSLA position was incredibly outside for me. I decided to take my foot off the gas and start using that modest income for other things.

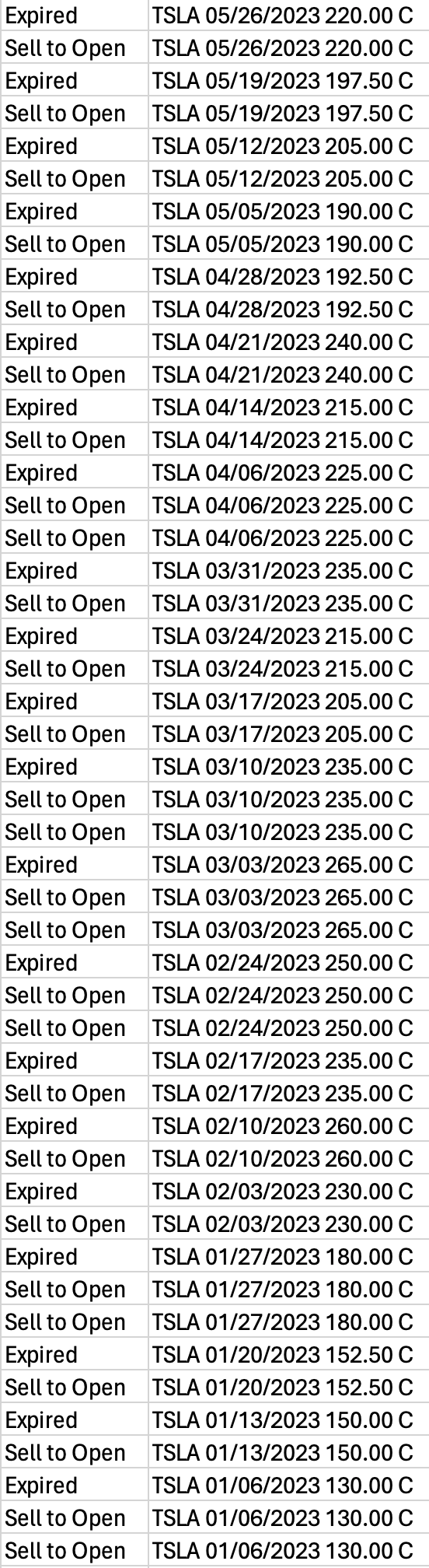

Phase 2: The “Boring” Income Stream (2023)

The middle years of this journey taught me patience. There were long stretches where Tesla traded sideways or dipped. For a buy-and-hold investor, these years are frustrating. For a covered call seller, they are profitable. This was the period I realized selling covered calls on Tesla was a viable path to a real income stream. Because of this I was relatively risk off and was selling strike prices slightly further out of the money.

My logs are filled with the word “Expired.”

- Sell to Open -> Expired.

- Sell to Open -> Expired.

This is the ideal outcome. I kept my shares, and I kept the cash. During these years, the income wasn’t flashy, but it was consistent. It allowed me to make some money and kept me engaged with the market every week. The nice thing about having an income stream like this is it makes you more averse to making irrational decisions. I constantly had a feeling of progress even if it was small, this helped me avoid the temptation of trying some exotic trading strategy destined to take it all away from me.

Personally this also allowed me to have a feeling of stability. I live over 1,000 miles away from my direct family and although I could go home if things really hit the fan, the feeling of having a modest income stream I dont need to rely on an employer for was incredibly freeing. My mindset changed from earnings maximization to ownership maximization. I realized that income can scale with one of two things. The first option most people choose is your time spent. This is an easy equation hourly wage x hours worked = income. The second path is based on what you own. I decided to shift into an ownership mindset. I want my money to work for me and I could achieve this by selling covered calls on my Tesla shares.

Phase 3: Chasing Yield & Dialing Up the Risk (Early 2024)

After years of “boring” consistent returns, I got comfortable, way too comfortable. In early 2024, I decided to turn up the dial. I looked at the premiums I was collecting at 10% out of the money and compared them to the premiums for strikes just 5% out of the money. The difference was intoxicating. I could nearly 10x my annual covered call income and I already knew how to roll so I though the risk was mitigated.

I shifted my strategy:

- Old Target: Sell calls ~8-10% OTM (Safety first).

- New Target: Sell calls ~5% OTM (Yield first).

For several months, this worked beautifully. My weekly income multiplied and I felt like I found a money cheat code. The stock would move up, but because I was selling closer to the money, the time decay (theta) ate away at the option value faster, and I was pocketing significantly larger checks. To be honest, it’s embarrassing to admit but I felt like a genius who had “solved” the volatility puzzle and found an evergreen income stream.

But in the words of Nicholas Taleb and many others, I was picking up pennies in front of a steamroller. By consistently selling strikes just 5% above the current price, I left myself almost no margin for error. I had removed the “conservative buffer” I built my system on.

It was this aggressive stance that set the stage for what happened next. When the stock finally made a real move, I didn’t have my usual 10% cushion to absorb the shock. I was standing right on the tracks.

Phase 4: The Crisis (The “Roll” of Late 2024)

Every covered call writer eventually faces the test they have been dreading. Mine came in December 2024.

Tesla stock went on a parabolic run sparked by the election of Donald Trump and the perceived value that would bring to Tesla (that was a bad assumption). From the very start I personally thought a Trump victory would be at best a slight positive for Tesla. Trump very clearly said he would take away the subsidies all OEMs relied on to stay afloat in the EV space leaving Tesla as the only real competitor that can stand on its own two feet even if it was hurt by lowered subsidies itself. A Harris victory on the other hand would have meant the lucrative subsidies kept flowing.

With the stock price ripping, my short call options went deep in the money. I was trapped. The options I had sold were now trading at a value so high that buying them back seemed ridiculous. But if I did nothing, I would lose my shares the one thing I would never consider doing.

On December 26th, I stared at a deficit on my screen that made my stomach turn. To save my position, I had to execute a massive “roll up and out.”

The cost to buy back those losing calls was a debit equivalent to 2 years of my annual salary.

Let that sink in. To close a single trade, I had to “spend” an amount of money that would take me almost three years (after taxes) of working 40 hours a week to earn. To the untrained eye, seeing a negative number that large looks like financial ruin.

But I didn’t pay it out of pocket. I used the market’s extreme volatility to fund my escape.

- The Loss: I bought back the drowning calls for that staggering 2x salary debit.

- The New Trade: In the same breath, I sold new calls expiring six months later (June 2025) at a higher strike price.

- The Credit: The market paid me a premium for those new calls that was even larger. I was able to credit an extra~$1k for a 6 month wait, not ideal but at least the strike price is much higher and further away.

The Result: I cleared the massive debt instantly, moved my strike price up to capture more growth, and pocketed a net credit.

I effectively moved a sum of money larger than most people’s life savings in a fraction of a second, “realizing” a multi-year salary loss and immediately offsetting it with a multi-year salary gain. It was the most stressful five minutes of my life, but it proved the system worked: I kept my shares, avoided a tax bomb, and survived the crisis while still generating a small amount of income while I wait.

To speak briefly on the feeling of seeing 2x your salary in red numbers on your screen, it is difficult. Working in commercial lending has helped me build an immunity to large numbers and their effect on normal people but even still, knowing its your money does make it different. Luckily I was able to convince myself, worst case scenario, I wait for this short option to near expiration and I roll up and out again for another credit even if its low. I could do that until either the stock came back down, or I decide enough is enough and let the shares get sold and I keep a big profit on my shares I held for the past decade ending my Tesla journey with a big win, just not as big as it could have been if I was only long the shares.

Phase 5: Diversification (2026 and Beyond)

As we moved into January 2026, my strategy evolved. My Tesla position had grown significant enough that I no longer needed to aggressively reinvest every penny back into TSLA. I started selling covered calls on Tesla as income to diversify into other assets.

My recent transactions show a steady rhythm of weekly income:

- Jan 5, 2026: Sold $485 calls. Expired.

- Jan 12, 2026: Sold $480 calls. Expired.

- etc.

The premiums are healthy, often generating significant weekly cash flow. Now, instead of just buying more Tesla, this capital can be deployed into other sectors, essentially allowing my Tesla shares to fund the rest of my financial life.

Conclusion

Selling covered calls on Tesla isn’t free money. You cap your upside in the short term, and you take on the stress of managing positions when the stock rips higher. On Tesla that happens frequently which is stressful but thats why the IV is so high and you get so much premium. But for a long-term bull who wants to hold for the next decade, it is a powerful tool.

It has allowed me to survive the downturns, capitalize on the volatility, and accumulate a position size that wouldn’t have been possible with “buy and hold” alone.

If you are considering this strategy, start small, understand the mechanics of rolling, and be clear about your goal. For me, the goal isn’t to sell the stock, it’s to get paid while I wait for the future.

Written by Hayden

Leave a Reply